Can Cryptocurrency Replace Traditional Money?

Cryptocurrencies have rapidly emerged as a significant force in the financial world, prompting discussions about their potential to replace traditional money. As digital assets operating on decentralized networks, cryptocurrencies offer an alternative to government-issued fiat currencies. This article explores the feasibility of cryptocurrencies supplanting traditional money by examining their characteristics, advantages, challenges, and the evolving financial landscape.

Understanding Cryptocurrencies and Traditional Money

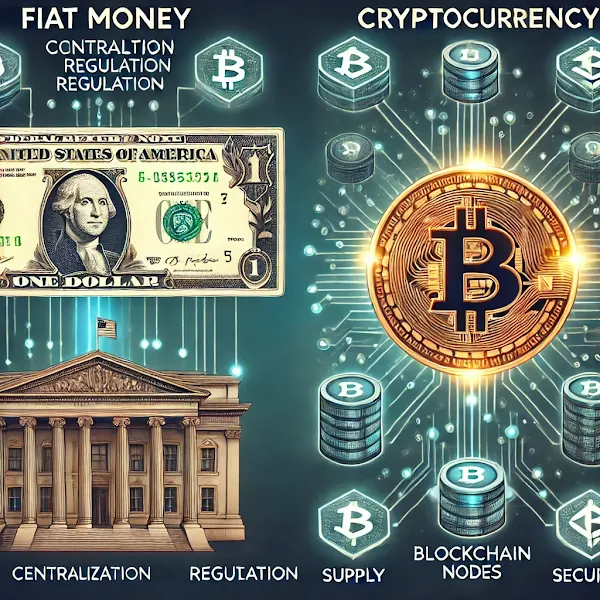

Traditional money, or fiat currency, is government-issued legal tender not backed by a physical commodity but by the government's authority. Examples include the US Dollar, Euro, and Indian Rupee. These currencies are centralized, with monetary policy controlled by central banks, and are widely accepted for transactions within their respective economies.

In contrast, cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks based on blockchain technology. Bitcoin, introduced in 2009, was the first cryptocurrency, and thousands have since been developed. Cryptocurrencies are not controlled by any central authority, offering a peer-to-peer system for transactions.

Key Differences Between Cryptocurrencies and Fiat Money

- Centralization vs. Decentralization: Fiat currencies are centralized and regulated by governments and central banks, whereas cryptocurrencies operate on decentralized networks without a central governing body.

- Physical Form: Fiat money exists in both physical (cash) and digital forms, while cryptocurrencies exist only digitally.

- Supply Control: Central banks control the supply of fiat money, adjusting it based on economic conditions. In contrast, many cryptocurrencies have a fixed supply determined by their underlying protocols.

- Legal Status: Fiat currencies are legal tender by law, whereas the legal status of cryptocurrencies varies by jurisdiction and is often subject to regulatory scrutiny.

Advantages of Cryptocurrencies Over Traditional Money

1. Decentralization and Autonomy

Operating on decentralized networks, cryptocurrencies allow users to transact directly without intermediaries like banks, reducing transaction fees and increasing autonomy over one's funds.

2. Security and Transparency

Blockchain technology ensures that all transactions are recorded on a public ledger, providing transparency. The use of cryptographic techniques enhances security, making it difficult for transactions to be altered or tampered with.

3. Accessibility and Inclusion

Cryptocurrencies can be accessed by anyone with an internet connection, offering financial services to unbanked populations and facilitating cross-border transactions without the need for traditional banking infrastructure.

4. Inflation Resistance

Many cryptocurrencies have a capped supply, such as Bitcoin's 21 million coin limit, which can protect against inflationary pressures that affect fiat currencies due to excessive money printing.

Challenges Facing Cryptocurrency Adoption

1. Volatility

Cryptocurrency prices are highly volatile, with values subject to significant fluctuations over short periods. This instability makes them less reliable as a store of value and medium of exchange.

2. Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate cryptocurrencies. This uncertainty can lead to legal challenges and hinder adoption by businesses and consumers.

3. Security Concerns

While blockchain technology is secure, the broader cryptocurrency ecosystem has been plagued by hacks, scams, and frauds, leading to significant financial losses and eroding trust among potential users.

4. Scalability Issues

Many cryptocurrency networks face scalability challenges, with limited transaction processing capabilities leading to delays and higher fees during peak usage periods.

The Future of Money: Coexistence or Replacement?

1. Integration into Existing Systems

Financial institutions are increasingly exploring ways to integrate cryptocurrencies into their services, offering custody solutions and facilitating crypto transactions, suggesting a trend toward coexistence rather than outright replacement.

2. Development of Central Bank Digital Currencies (CBDCs)

Many central banks are researching and developing their own digital currencies, known as CBDCs, which aim to combine the benefits of digital transactions with the stability of fiat currencies. This development could lead to a hybrid monetary system where CBDCs and cryptocurrencies coexist.

3. Adoption in Economically Unstable Regions

In countries facing economic instability and hyperinflation, cryptocurrencies can offer an alternative means of preserving value and facilitating transactions, potentially leading to higher adoption rates in such regions.

FAQs

1. Can cryptocurrency fully replace traditional money?

While cryptocurrency has the potential to complement traditional money, full replacement is unlikely in the near future due to regulatory, economic, and infrastructure challenges.

2. Are cryptocurrencies safe to use for everyday transactions?

Cryptocurrencies are secure, but price volatility and lack of widespread merchant adoption limit their practicality for everyday transactions.

3. Will governments accept cryptocurrency as official money?

Some governments are exploring regulations, but most do not recognize cryptocurrency as legal tender due to control concerns and economic stability risks.

Conclusion

While cryptocurrencies present innovative features and potential benefits over traditional money, several challenges must be addressed before they can replace fiat currencies. Factors such as volatility, regulatory hurdles, security concerns, and scalability issues currently limit their ability to serve as a universal medium of exchange. The future likely holds a scenario where cryptocurrencies and traditional money coexist, each serving distinct roles within the global financial ecosystem.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are subject to market risks.

No comments:

Post a Comment

I genuinely appreciate you taking the time to read this blog post. Your support, comments, and engagement mean so much to me. Whether you’re here for the first time or have been following along for a while, I’m grateful to have you as part of this journey.

If you found value in this post, please consider sharing it or leaving a comment—your feedback helps me create content that resonates with you. Thank you for being a part of this community!

Warm regards,

Daily Boost Guide